CMC Markets Broker Reviews and Full Information

What exactly is CMC Markets?

English brokerage CMC Markets have a serious "Life experience" since the company was founded up to 1989. It is now among the largest broker-makers on the forex market.

Since its inception from the UK, CMC Markets has expanded its reach and opened offices across the world with offices in Australia, Austria, Canada, France, Germany, Ireland, Italy, New Zealand, Norway, Poland, Singapore, Spain and Sweden and Sweden, making it one of the leading online CFD brokers in the world..

Are you sure that CMC Markets good broker?

As a company, the top priorities are set to enhance trade efficiency by developing and technological innovation. In addition, CMC Markets pays particular attention to trading programs designed for novice as well as experienced investors as well as the presence of several major broker firms as well as International investment fund.

CMC Markets Pros and Cons

CMC markets is one of the most highly known Brokers, with a simple online account opening, extensive platform tools , and excellent knowledge through research. Additionally, there are a variety of options for depositing or withdrawing funds.

On the other hand trading charges for Stock CFDs are higher and there isn't 24/7 helpline.

10 Points Summary

| Headquarters | UK |

| Regulation | FCA, ASIC, FMA, IIROC, MAS |

| Platforms | CMC Web, CMC Mobile |

| Instruments | Forex, Cryptocurrencies, Indices, Commodities, Shares, Treasuries Gults, bonds |

| Spread EUR/USD | 0.7 pip |

| Demo Account | Available |

| Minimum deposit | 0 GBP |

| Base currencies | Several currencies available |

| Education | Courses, learning materials videos |

| Customer Support | 24/5 |

Awards

Due to its years of experience in the industry with continuous growth and pursuits, CMC Markets has obtained numerous awards and recognitions. but only in the past two years, has received awards that exceeded 50 and counting.

awarded Best Platform Features as well as the Best Mobile Platform for Phones and Tablets • Information on Investment Trends UK

Rated the highest in the reliability of its platform and charting Based on the highest satisfaction of users among spreadbetters CFD and FX traders

Do you think CMC Markets safe or a fraud?

It's not true, CMC Markets is no scam. CMC Markets is one of highly regulated and reputable brokers with a long-standing time of operations. It is licensed and regulated by a number of top financial authorities: ASIC, IIROC, MAS. So, it's safe and risk-free to trade CFDs using CMC Markets.

Are CMC Markets regulated?

Regulated status is an important factor to verify whether a the broker is legal to trade or is a fraud. For CMC Markets the broker is highly regulated and licensed to offer trading services legally.

So, CMC Markets UK plc's headquarter CMC Markets UK plc and CMC Spreadbet plc is authorized and monitored through The FCA (UK) This means CMC Markets UK plc is in compliance with the clients assets regulation, also known as CASS, which guarantees the safety of traders.

Due to the presence of international companies and the presence of multinational companies, there are additional regulations that companies must surrender to which include Australian regulatory oversight of ASIC, Canadian IIROC authorization to function as an CMC Markets UK dealer. Other branches are subject to the supervision of The Financial Markets Authority in New Zealand and the Monetary Authority of Singapore (MAS).

| CMC Markets entity | Regulation and Licence |

| CMC Markets plc | FCA (UK) registration no. 173730 |

| CMC Spreadbet plc | FCA(UK) registration no. 170627 |

| CMC Markets Asia Pacific Pty Ltd | ASIC (Australia)registration number. ABN 11100058 213. AFSL No. 238054 |

| CMC Markets Canada Inc. | IIROC(Canada)and Ontario Securities Commission |

| CMC Markets NZ Ltd | FMA (New Zealand) |

| CMC Markets Singapore Pte Ltd | MAS (Singapore) registration no. No./UEN 200605050E |

What are the best ways to protect yourself?

In addition, CMC Markets Stockbroking Limited is a participant in the ASX Group (Australian Securities Exchange) and SSX (Sydney Stock Exchange) and Chi-X (Chi-X Australia), ABN 69 081 02851, AFSL No. 246381 (the stockbroking service provider) offers financial services and products. That means, it has the highest degree of responsibility and control over the company at the institutional grade scale.

In simple terms the regulatory status of CMC Markets ensures the traders security of their funds, and every client's funds are held in accordance with trust, property and insolvency laws is kept separate apart from CMC Markets' own funds which makes them inaccessible to the firm.

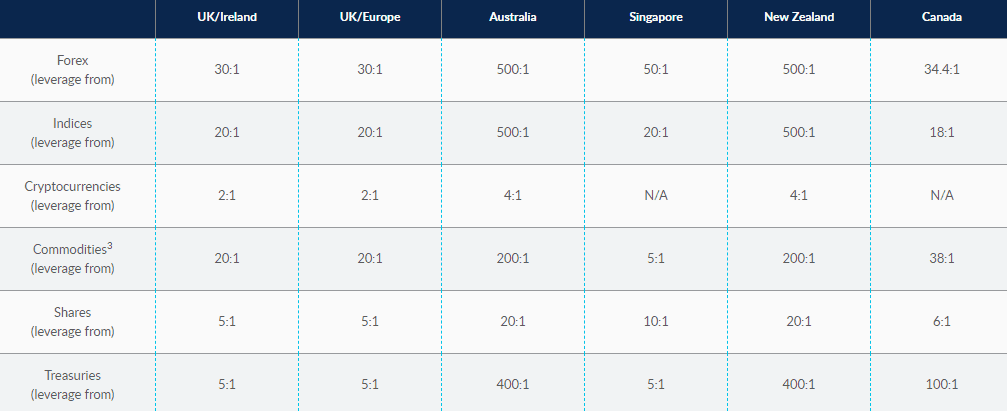

Leverage

Leverage is a loan granted from the broker trader that allows traders to trade in a greater volume that the deposit initially made is different from one company to the next.

As leverage increases the chance of gaining more however, it can also create bigger losses the standards of regulation establish a certain level that is considered secure.

However, the views of the authorities differ,

- While European clients are able to use the maximum leverage level of 1:3,

- The Australian as well as clients of New Zealand can enjoy leverage that can reach 1:500.

Additionally, professional traders could gain access to additional leverage and expand after the status is verified and this is on top of regulatory levers ' settings and so make sure to confirm these settings too.

Account types

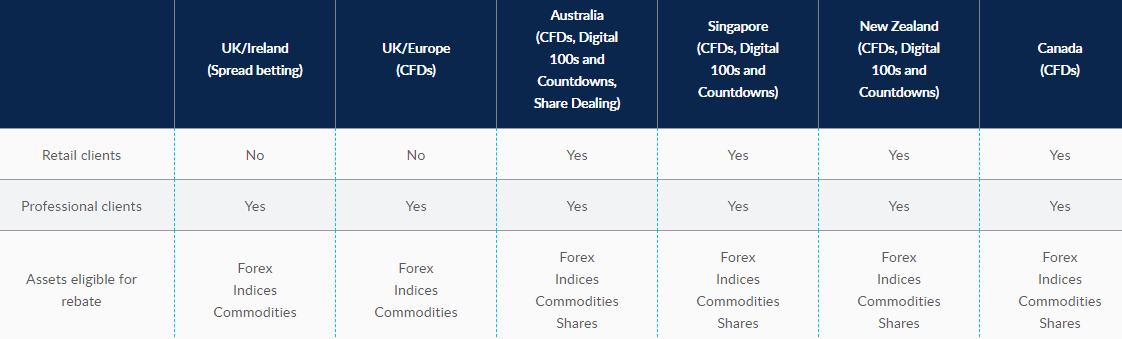

There are two kinds of accounts offered by CMC Markets including CMC Markets CFD trading and Corporate Account and you must be aware that advertising proposals that are set up with settings might differ slightly in their options in various regions because of the limitations of the regulatory framework.

In the case of standard trading it's one account feature which will allow you to choose the features adjusted according to the degree of control and the regulations of the business. Accounts offer identical features, and a useful collection of tools, but are specific to the trading requirements you choose to choose.

Instruments

The range of markets CMC Markets offering for the customers they serve is an extensive array of trading instruments that can go up to 10,000. They include Forex Currency Pairs that include 300+ currencies from around the world, cryptocurrency, Indices with major international, Commodities such as oil, silver, gold, and many more, Shares more than 9,000 companies, Treasuries Gults, bonds and treasury notes trading CFDs.

However, be sure to confirm the instrument range as per the regulation and specific laws that apply to you.

Fees

CMC Markets pricing is good and their fees are in line with the CFD spreads, which are quite competitive and commissions and spreads for the major FX pairs beginning at 0.7 points, one point on indices of key importance like that of UK 100, and Germany 30 and 0.3 points for Gold. Margin rates begin at 3.3 percent for forex as well as 5percent for indexes and commodities and 20 percent for treasuries and shares. All fees are included. We also observe charges for inactivity, fund fees as well as the overnigh swap.

| Fees | CMC Markets Fees | Pepperstone Fees | XM Fees |

|---|---|---|---|

| Fee for deposit | No | No | No |

| The fee for withdrawing | Yes | No | No |

| Fee for inactivity | Yes | Yes | Yes |

| Fee position | Low | Low | High |

CMC Markets Spreads

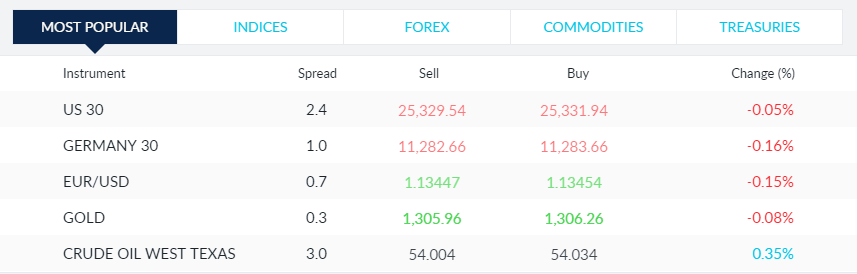

CMC Market Spreadtruly thought of as among brokers' benefits, but you must remember that the spread is minimal, which can be seen on the following table. It also shows an average spread throughout all of the trading period, as spread can fluctuate under highly fluctuating conditions. For instance the average spread for EUR/USD for 2019 is 0.805.

Furthermore, the rate of holding that is used to calculate the cost of holding on FX is derived from the tom-next rates, which refers to the differences between two currencies rate of interest, and an additional 1 percent CMC Markets charge added.

| Asset/ Pair | CMC Markets Spread | Pepperstone Spread | XM Spread |

|---|---|---|---|

| EUR USD Spread | 0.7 Pips | 0.2 pip | 1.6 pip |

| Crude Oil WTI Spread | 3 pip | 8 pip | 5 pip |

| Gold Spread | 3 | 1.4 | 35 |

| BTC USD Spread | 0.75% | $10 | 60 |

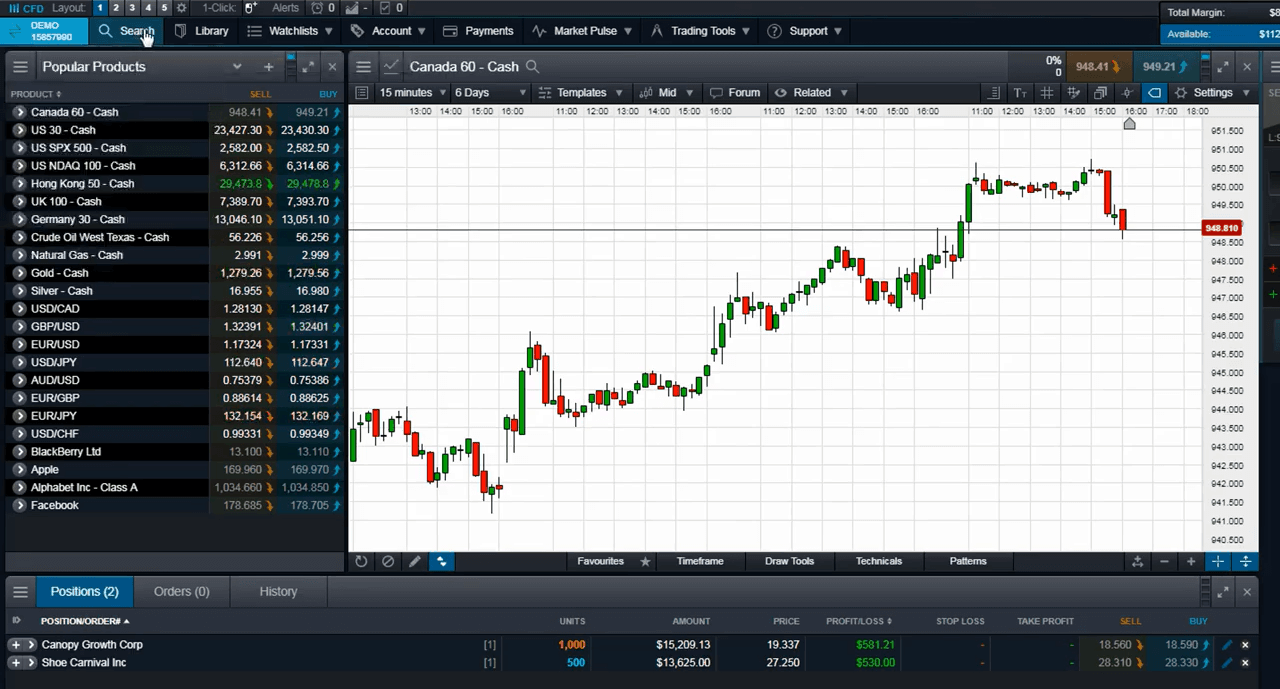

Snapshot of quote reference

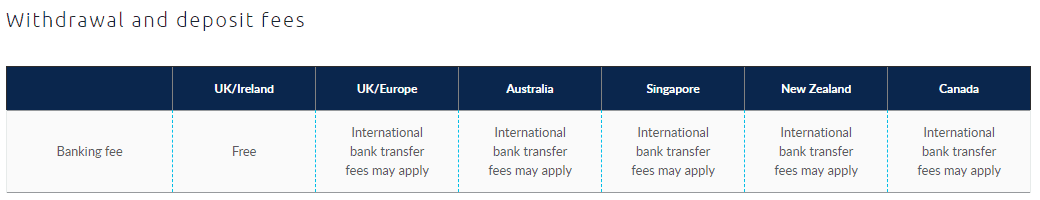

Deposits and withdrawals

CMC Markets offers its clients the most "modest" set of payment options that are limited to bank transfer along with Visa and Master Card. However, narrowed the range of financial instruments balanced by the quality of services provided, since every transaction is processed within one or two business days.

CMC Markets minimum deposit

It is the Minimum deposits amount for CMC Markets mentions no minimum amount required to begin trading however, the broker suggests placing a minimum deposit of 200 GBP to cover costs, margins and other expenses.

CMC Markets minimum deposit in comparison to other brokers

| CMC Markets | The majority of other brokers | |

| Minimum Deposit | $0 | $500 |

Withdrawals

These withdraws are processed very quickly by CMC Markets, while there is no cost for CMC Markets to withdraw money, either to deposit or withdraw.

However it is possible that your Bank could charge an additional charge for Banking or international bank transfer which must be paid by the client. For instance, you can check and compare fees to BDSwiss.

Trading Platforms

In actual fact, CMC Markets has an remarkable trading technology advantage , with patent-protected platforms that are ranked with the highest surveys and analysis.

| Pros | Cons |

|---|---|

| Proprietary trading platform | There is no MT4 alternative |

| Design and layout that is user-friendly, as well as login | |

| Price alerts | |

| Many languages are supported, as well as technical analysis and robust features | |

| The tools of Numerus are included within the package | |

| Standard and Advanced versions |

Web Platform

Innovative platforms that offer mobile and web versions that work with any device iOS and Android and Android, backed by the most innovative trading tools, such as the client sentiment, which allows you to see how many clients as well as their value of positions.

In addition, there are a variety of multiple asset and pattern recognition scanners that inform the client of potential trading opportunities.

Desktop trading

There is a wide range array of tools and features in CMC Markets. CMC Markets software typically with all the features that are available in the desktop edition. It is among the most effective and common to the most innovative we'll look at what's available in a short amount of time, but make sure to get out and experience how powerful this platform could be.

The ability to access spread betting which can be tax free trading for traders. Spread betting allows a trader who wishes to bet spreads on forex and indices, commodities as well as treasuries and shares. Spread betting, however, is only accessible to UK as well as Ireland residents.

* Digital 100 trading is the possibility of speculating on the financial markets, with a low risk , automated execution, and intervals of timeframes starting at 5 minutes and ending with full access to a sophisticated charting program.

* Countdowns is an CMC Markets unique way to trade with minimal risk on the short-term price market fluctuations using timeframes ranging from 30 seconds and a choice that the price will either increase or decrease.

Mobile Trading

Mobile application is well developed and highly rated in the business, in addition being a great customization, you can access basic analysis and features available on your phone.

Furthermore, it is it is crucial to consider the various risk-management options designed to safeguard potential gains and reduce losses. Therefore, you or anyone else trader can be sure that your trading order will be completed at a precise price, thanks to the guarantee of stop-loss orders.

Customer Service

The beginner traders or even the more experienced traders are sure to appreciate CMC Markets technical support and CMC markets trading service, which is regarded to be among the most effective available in the market in addition to the opportunity to experience trading at an risk free Demo Accounts.

The customer support is available around the clock , also assisting live chat, telephone lines and can be reached via various ways.

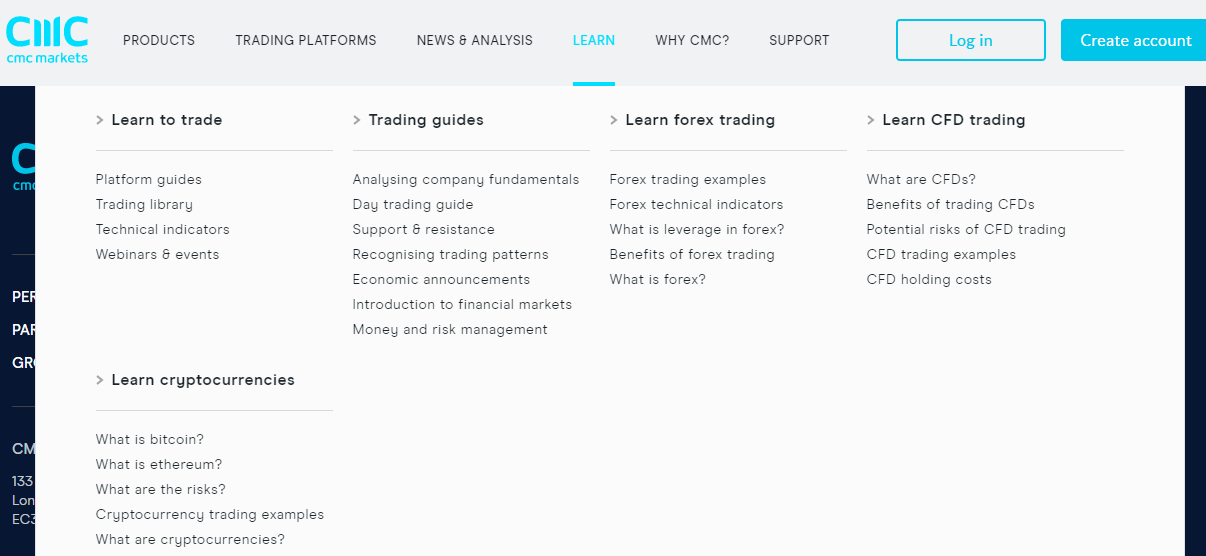

Education

Alongside the dependable customer support, customers can expect an opportunity to connect online with renowned experts in the field, who are invited to webinars by the company. You will also discover a extensive learning center that is defined by the subject you are looking to master or increase your understanding that we found to be well organized when we did CMC Markets Review.

Conclusion

In the end, CMC Markets provides great trading condition because of their extensive knowledge of the trading industry for over 30 years and a focus on the customer who always looks at how to improve the value of money and reducing trading costs low with lower margins and competitive spreads. CMC Markets does not offer an extensive range of account types or options, intuitive platform that allows trading with a user-friendly, proprietary platforms and apps, an array of instruments and trading instruments, extensive platform development, and the broker's real trustworthiness.

| Properties | Values |

|---|---|

|

Name

|

CMC Markets |

|

Minimum Diposit

|

$ 1 |

|

Leverage

|

300:1 |

|

Regulation

|

ASIC (Australia),FCA (United Kingdom),,, |

|

Headquarters

|

United Kingdom |

|

Established

|

1989 |

|

Address

|

133 Houndsditch London, EC3A 7BX, United Kingdom |

|

Platform

|

MT4,MT4 WebTerminal,,, |

|

Payment Method

|

Visa,Mastercard,Credit Card,Wire,,, |

| Properties | Values |

|---|---|

|

Spreads

|

0.7 pip |

|

Min Position size

|

0.01 |

|

Broker Type

|

MM ( Market Maker),Instant Execution,,,,, |

|

Account Type

|

Cent account,Mini account,Scalping,High Leverage,Standard,,, |

|

Brokers by Country

|

UK Forex Brokers,,, |

|

Techniques

|

Hedging Forex Brokers,Carry Trade Brokers,Automated Trading Brokers,Mobile Trading Brokers,,, |

|

Instruments

|

Forex Trading Brokers,Futures Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Crypto Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers,Metal Trading Brokers,Indexes Trading Brokers,,, |

|

Account currency

|

USD,EUR,GBP,,USD,,USD, |

|

Tools

|

Charting Software,,, |

|

Website Languages

|

en,,, |

|

Support languages

|

en,,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.2 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Low forex fees 2. Great web and mobile platforms 3. Advanced research and educational tools |

|

Cors

|

1. High stock CFD fees. 2. Only CFDs are available. 3. Customer support only 24/5 |

|

Display Analysis

|

Yes |

|

Serving country

|

AU,AT,CA,DE,IE,NZ,NO,PL,SG,ES,SE,GB,,, |

|

Not Serving country

|

US,,, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,Mql5 signals,,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44 (0)20 7170 8200 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *