Capital Index Broker Reviews and Full Information

What is Capital Index?

In 2014, Capital Index was founded. Capital Index is an international online brokerage firm that has established operations in the UK, Europe, Australia as well as worldwide, sharp regulation and a focus on CFDs. Financial Spread Betting and Spread Trading for a variety of financial instruments, including Foreign Exchange (FX), Commodities, Indices and Metals.

Capital Index Capital Index team, with an extensive experience in the business is aware that providing excellent customer assistance and service along with cutting-edge technology is the key to performance of the industry. This is why Capital Index has invested a lot of money in a modern technological infrastructureto create a streamlined trading environment and to ensure continued expansion.

Capital Index's system uses the no-dealing desk execution (NDD)that allows an open, quick as well as secure trades. This means you get the most competitive prices on the market with absolute security. This makes your trading options broader and more effective.

Capital Index Pros and Cons

Capital Index is a broker that has an FCA license and clear conditions. Capital Index's NDD execution is ideal for the platforms. Capital Index provides with low spreads.

The downside is that there isn't a professional education section, which is in contrast with other brokers, and instruments are restricted only to Forex or CFDs.

10 Points Summary

| Headquarters | UK |

| Regulation | FCA, SCB |

| Platforms | MT4 |

| Instruments | CFDs, Financial Spread Betting and Spread Trading, FX, Commodities, Indices and Metals |

| EUR/USD Spread | 1.4 pip |

| Demo Account | Available |

| Minimum deposit | 100 US$ |

| Base currencies | USD, EUR, GBP |

| Education | Webinars, Seminars, Daily Outlooks |

| Customer Support | 24/5 |

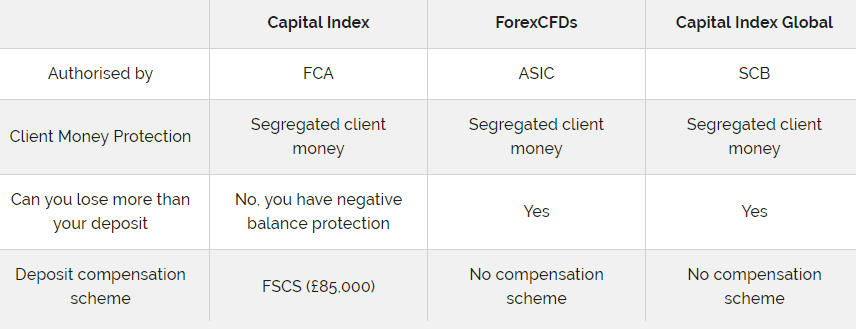

Are Capital Index safe or a fraud?

Capital Index is not a scam. Capital Index is not a fraud Capital Index with its headquarters located in London has been approved and controlled by the UK by the Financial Conduct Authority whish is recognized under the name of Capital Index UK Limited and via its Bahamas office that is registered with SCB is named Capital Index Global Limited.

In addition, the broker works with a prominent brokerage firm in Australia under the name of Cardiff Global markets Pty Ltd under the trading designation of ForexCFDs'. It is controlled under ASIC. Australian ASIC.

In simple terms heavy regulation is the term used to describe the need to adhere to and operate under security precautions in accordance with regulations, apply numerous restrictions while controlling how brokerage operations are conducted. Thus, all funds of clients are kept separate and separately in bank accounts making sure that the funds of clients are not used for corporate purposes.

Capital Index applies also an operational model that was developed by internationally recognized body that creates an environment that is uniform that is characterized by transparency in the financial sector, competition and greater protection for consumers for investment services throughout the EEA and around the world.

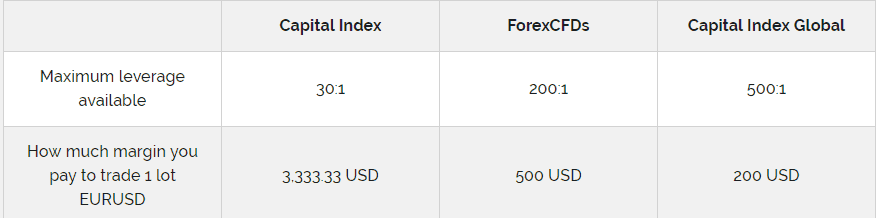

Leverage

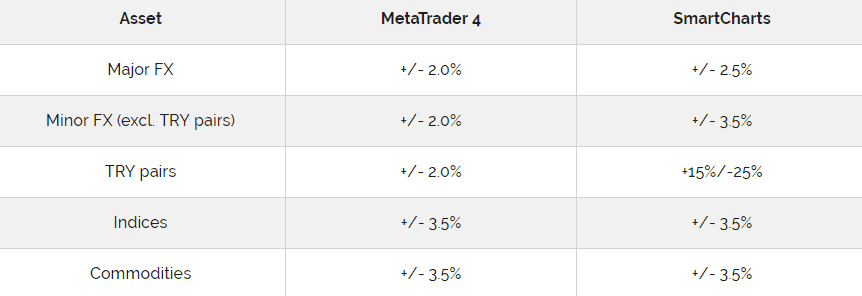

The levels of leverage that Capital Index offers Capital Index does depend on the organization you are trading with. This is due to a variety of regulations that differ between the authorities. Thus, Australian clients trading on Capital Index AU can benefit from the highest leverage levels of up to 1:500 on Forex instruments and European as well as UK clients can make use of as low as 1:30 in Forex instruments.

Types of accounts

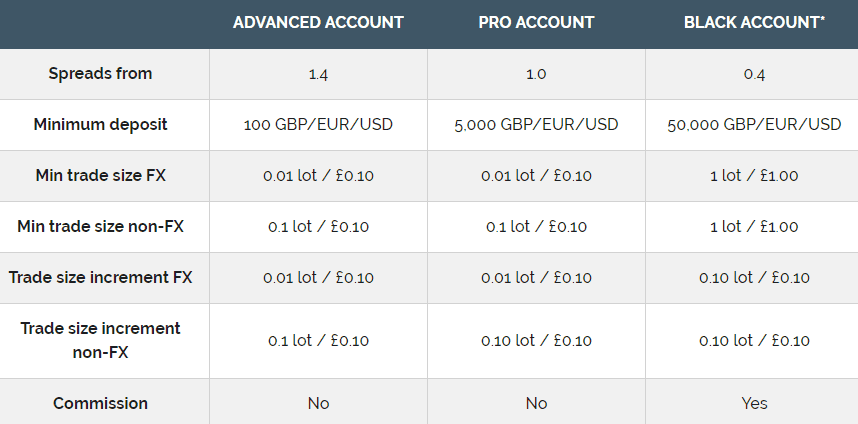

You can select from three different kinds of accounts at Capital Index, plus to that, the Islamic Account offering for traders that adhere to Sharia rules. All accounts are supported through the VPS service, with various leverage levels, read the next paragraph as well as you can also use the STP implementation model.

In the beginning, anyone can sign up for an demo account risk-free using Capital Index.

Fees

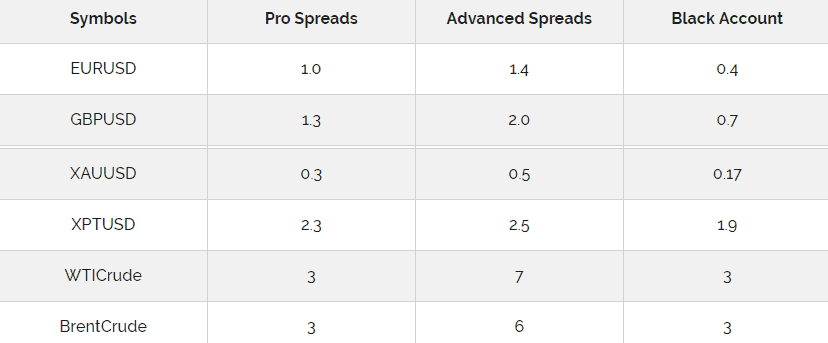

Although different types of accounts are designed to cater to different requirements for trading all offers a smaller spreads providing when the trading volume grows. Particularly, look at Capital Index spreads comparison below as well as examine fees with another popular brokerage EVFX.

Also, be sure to consider the overnight cost or swap as a cost for trading when you have an open position for more than a day, different fees will apply and are listed below. Alongside the funding fee and any other fees that might be incurred.

| Fees | Capital Index Fees | Trading 212 Fees | Infinox Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee rating | Average | Low | Average |

Spreads

Capital Index Spreads are different according to the type of account you select. See the below for a comparison.

| Asset | Capital Index Spread | Trading 212 Spread | Infinox Spread |

|---|---|---|---|

| EUR USD Spread | 1.4 pip | 0.9 Pips | 1.3 pip |

| Crude Oil WTI Spread | 7 | 4.8 pip | 4.7 |

| Gold Spread | 0.5 | 0.35 | 0.27 |

Deposits and Withdrawals

Capital Index accepts the most popular payment methods. This include debit card, credit card transactions, as well as Bank Transfer.

Withdrawal

Capital Index introduces the new option for withdrawal - The Capital Index Prepaid MasterCard. When clients withdraw funds from their account, the money is transferred to the card immediately when they are taken out of the account for trading. It permits the card to have similar features to the MasterCard offers all over the world. The card's issue cost is 10dollars, and a the monthly operating fee is added to the amount of 1.95$1.

Another plus is that it is that there's no fees for withdrawals or deposits or withdrawals, unless you wish to complete a withdrawal on the next day.

Minimum deposit

The minimum amount you can deposit is 100 units of the base currency you use dependent on your type of account as well as the one you select to use as your primary one.

Capital Index minimum deposit, compared to other brokers

| Capital Index | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Trading Platforms

For Capital Index, the trading software Capital Index offers the ability to make the financial spread betting spread trades, spread trades and CFDs on Foreign Exchange (FX), Indices and Commodities. These markets are traded on the most well-known and downloaded trading system MetaTrader 4 as well as the possibility to trade via mobile devices.

The platform permits you to make use of EAs which monitor markets for you and executing according to the established rules for trading in your name.

The MT4 is a popular choice due to its abundance of information, simple but powerful data charts, custom indicators and charts. In addition, MT4 brings the possibility of trading direct through the chart using a manual or automated manner via EAs.

Education

Capital Index customer support through a variety of convenient to ways to the client. The company offers extensive educational resources that are geared towards every level of experience in trading by offering regular webinars and seminars and weekly video news updates of the most important economic data.

Conclusion

Final thoughts on Capital Index review is clear that the broker is a dependable choice and is regulated by two significant authority in the field. In general, Capital Index satisfies the most common and convenient requirements of traders to offer. In addition, they provide a secure platform that offers extensive trading tools and a variety of instruments to analyze, strategies improvements and functions that are facilitated by the the STP execution model and price competition that eliminates any conflict between the customer and the business. The brokers' learning resources, easy assistance, and stable co-operation makes it an excellent choice to select from.

| Properties | Values |

|---|---|

|

Name

|

Capital Index |

|

Minimum Diposit

|

$ 100 |

|

Leverage

|

1:30 | 1:500 |

|

Regulation

|

SCB (Bahamas),SCB (BS) (Bahamas),FCA (United Kingdom), |

|

Headquarters

|

Bahamas |

|

Established

|

2010 |

|

Address

|

Lyford Financial Centre, Western Road, Lyford Cay, Nassau, Bahamas |

|

Platform

|

MT4,MT4 WebTerminal, |

|

Payment Method

|

Visa,Mastercard,Wire, |

| Properties | Values |

|---|---|

|

Spreads

|

1.4 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),NDD (Non Dealing Desk),,,, |

|

Account Type

|

Mini account,Islamic account, |

|

Brokers by Country

|

UK Forex Brokers, |

|

Techniques

|

Hedging Forex Brokers,Carry Trade Brokers,Automated Trading Brokers,Mobile Trading Brokers,Day Trading Brokers, |

|

Instruments

|

Forex Trading Brokers,Futures Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Metal Trading Brokers,Indexes Trading Brokers, |

|

Account currency

|

USD,EUR,GBP, |

|

Tools

|

Economic Calendar,Charting Software, |

|

Website Languages

|

en, |

|

Support languages

|

en, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.0 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. FCA Regulated |

|

Cors

|

1. No MT5 Trading platform. |

|

Display Analysis

|

Yes |

|

Serving country

|

BS,GB,VN, |

|

Not Serving country

|

CA,US, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

PAMM,Myfxbook Auto trade,Mql5 signals, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+1 844 8074302 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *