Amana Capital Broker Reviews and Full Information

What exactly is Amana Capital?

Amana Capital is a financial service company that offers brokerage services to international markets via its offices within Beirut, Dubai, Cyprus and London.

The Amana Capital Group comprises five major entities which include Amana Finance Services-UK Amana Financial Services (Dubai) Limited, Amana Capital SAL-Lebanon Amana Capital (Cyprus) Limited and TradeCaptain.com.

In actual fact, the creation of Amana Capital offices enabled the group to increase the range of services offered and also provide the ability to global markets for trading with the help of cutting-edge technology that anticipates the investor's institution or personal demands.

Amana Capital Pros and Cons

Amana Capital is a broker with a stellar reputation, and has multiple regulations to ensure a safer environment. They offer a good selection of trading platforms and strategies that are not restricted cost are generally affordable, and the research and education sections are outstanding.

In the Con the Account Conditions and fees could differ depending on the rules, so they could be higher for certain companies.

10 Points Summary

| Headquarters | UK |

| Regulation | FCA, CySEC, DFSA |

| Instruments | Forex (Currencies), Spot Metals (Gold, Silver) and Futures (Crude Oil, Stock Indices) |

| Platforms | MT4, MT5 |

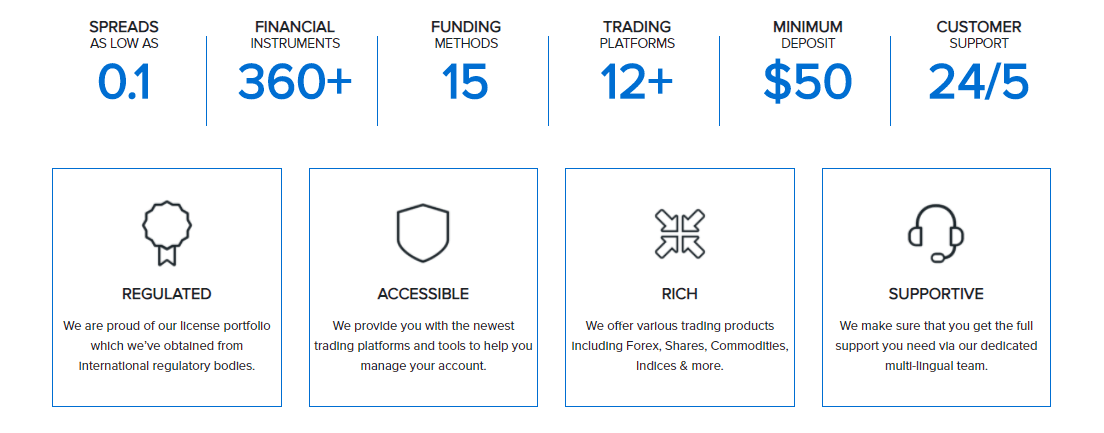

| Spread EUR/USD | 1.4 Pips |

| Demo Account | It is a service that is offered |

| Base currencies | GBP, EUR, USD, etc |

| Minimum deposit | 50 $ |

| Education | Established TradeCaptain.com offering a variety of educational resources |

| Customer Support | 24/5 |

Awards

In the course of its operations and achievements Amana Capital Group has been able to achieve a number of achievements. Amana Capital Group became an award-winning brokerage firm as well as other advantages they provide and will further discuss in the Amana Capital Review.

Does Amana Capital safe or a scam?

There is no, Amana Capital is regulated by the highest-level authority FCA considered to be safe and low risk Forex brokerage.

Is Amana Capital legit?

Amana Capital through its five principal entities is controlled by knowledgeable local bodies that are required in all jurisdictions where the broker has a branch is located.

So, Amana Capital complied its trading services in accordance with the strict regulations that are set by the world's most reputable authorities, including FCA, Dubai DFSA, CMA, and CySEC.

| Amana Capital entity | Regulation and Licence |

| Amana Financial Services | Registered to be registered by FCA (UK) Registration number. 605070 |

| Amana Financial Services (Dubai) Limited | Autorized by DFSA (Dubai)registration number. F003269 |

| Amana Capital SAL | Approved by Central Bank of Lebanon No. of registration. 60 |

| Amana Capital Ltd. | Autorized through CySEC (Cyprus) authorization number. 155/11 |

| AFS Global | The authorization was granted through LFSA (Malaysia) to register number. MB/18/0025 |

| ACG International | Accredited through FSC (Mauritius) authorization number. C118023192 |

How can a trader be protected?

In accordance with its various regulations and regulations, according to its numerous regulations, the Amana group provides secure trading conditions and has a strategic focus focused on providing a secure and reliable trading environment to customers. In accordance with international standards, each measure sets their own rules, which generally include protection for investors, operational standards and risk management proceduresgoverned by the laws applicable to them.

If you are a trader, it can rest assured that your money is always distinct from the broker's funds, as is its protection through the mechanisms in the event insolvency, a robust security measures and periodic audits.

Leverage

Amana Capital offering leverage as high as 1:500 that allows access to the market of forex for retail traders with a smaller dimensions, but the maximum leverage is dependent on the organization of Amana Capital you trading with. This means that, according to the regulations, each state has set and decided the limits that the broker can offer its customers.

- So, European traders with an account set up in either the UK, Cyprus or other countries will be able to comply with ESMA regulation that mandated a the maximum leverage of 1:30 to Forex instruments.

In fact, leverage can increase gains, but it is important to keep in mind that the losses could also be greater than the amount of money you have so you need to make sure you choose the right leverage and be aware of the risks you must take.

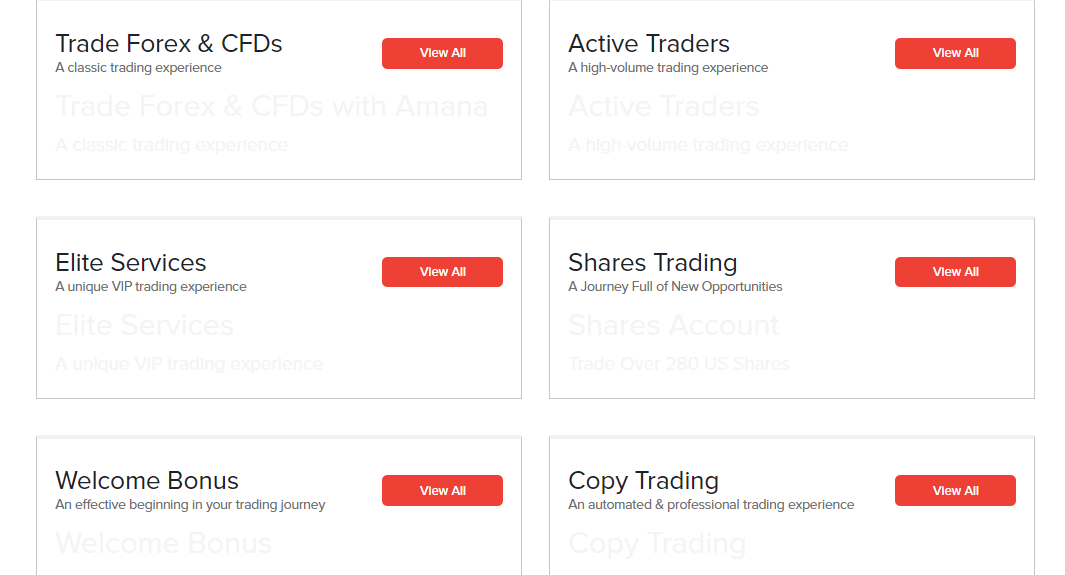

Types of accounts

The types of accounts do not vary based on trading volume, rather providing an individual solution for people who want trading CFDs and Forex. CFDs which are further defined in terms of Classic conditions and also with examples of fee terms. Activ traders can trade with interbank spreads and commission fee, they offer Elite services, Shares Trading and Copy trading all come with a customized solution depending on the type of account.

Alongside there is a demo account to practicing trades,all account designed with the competitive spreads starting at 0.4 pip, the flexibility of leverage from 1:500 to 1:500, access to small and macro lots as well as market execution that is positive slippage and no requotes.

Instruments

After you have signed up for an account, a broker will give you an access for trading financial instruments, including forex (Currencies) and Spot Metals (Gold Silver, Gold) as well as futures ( Crude Oil and stock indexes).

Fees

Amana charges are determined by the type of account you choose to use, and it is also adapted to the type of asset or instrument that you trade. No matter if the trader's a beginner or expert investor, the broker has the perfect solution using accounts of various types or technologies as well as every order is executed using market executionand V trading according to size of the trade and the platform.

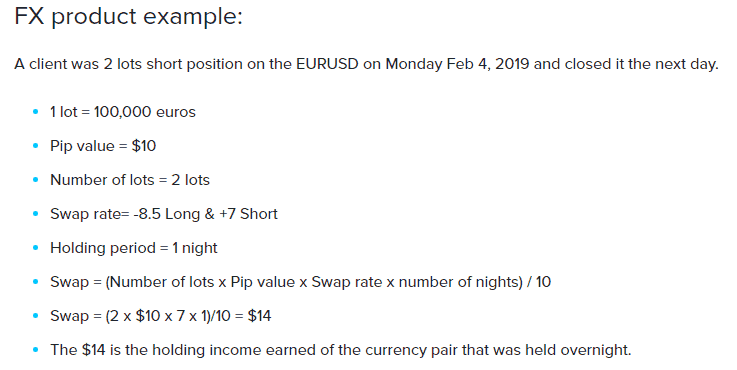

Rollover

Furthermore, you should take into consideration an overnight policy that is applicable in the event that the trading order is not completed within an entire day. In this scenario, a the rollover fee or swap fee is applicable to the transaction. Take a look at the following example.

| Fees | Amana Capital Fee | ActivTrades Fee | Swissquote Fee |

|---|---|---|---|

| Fees for deposits | No | No | No |

| Fees for withdrawal | No | No | No |

| Fee for Inactivity | Yes | Yes | Yes |

| Fee rating | Average | Low | Average |

Spreads

Classic account features spread-only basis, with a spread on EUR USD being 1.4 pip and there is no additional commission. Similarly, the Activ trades account comes with interbank spreads starting at 0 pip and a $30 commission per million traded in FX and 4% per lot for the Futures CFDs.

The fee conditions that are offered by Amana Capital are quite competitive in comparison to its other advantages for trading.

Look at the table below with other expenses to assess Amana Capital pricing offers. Amana Capital pricing offers, which are used for to define the Classic account base. You can find out the fees from another popular agent AvaTrade.

| Asset/ Pair | Amana Capital Spread | Spread from ActivTrades | Swissquote Spread |

|---|---|---|---|

| EUR USD Spread | 1.4 pip | 0.63 Pips | 1.7 pip |

| Crude Oil WTI Spread | 3 | 3 | 5 |

| Gold Spread | 20 cents | 35.75 | 28.6 |

| Spread BTC/USD | 74.1 | 1% | 1% |

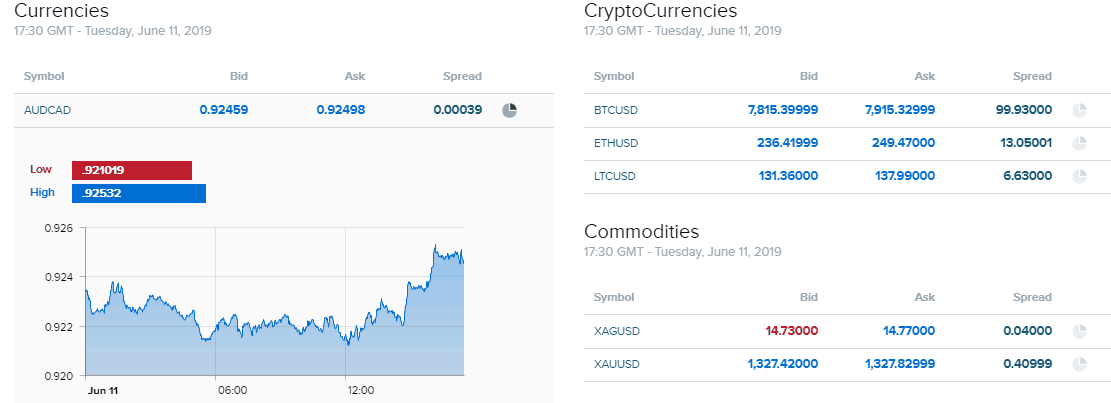

Photograph of Forex spread

Rollover

Furthermore, you should think about an overnight policy in the event that the trading order is not completed within one day. In this scenario, a the rollover fee or swap fee will apply to the trade. Check out the illustration below.

Methods for Funding

Amana Capital group Amana Capital group work with famous banks and facilitates the speedy transfer of deposit and withdrawals. However, customers from different countries may use various payment methods in addition to the processing deposits of fees for withdrawals when appropriate.

Deposit Options

Payment options, including the following options. In addition, recently Amana Capital added a new option. It's their very own Amana pre-paid credit card that is able to be used in like your bank card.

- Banking Transfers (typically Amana charges PS6 for the incoming Bank Wire transactions),

- Cards Payments (with 1.5 percent charge for deposits)

- and e-payments, or alternative payment methods such as Skrill, Neteller, WebMoney, Qiwi and more (fees depend on the method, starting at 2.8 and e-payments (fees vary according to method and starting from).

Is there a minimum amount of deposit for Amana Capital

For just 50dollars you can fund your account's first grade by using Amana Capital, which is perfect for all sizes of traders. But, the limit may be different based on the instrument or enttityt you intend to trade because margin requirements are in place. Be sure to check all of the conditions required.

Amana Capital minimum deposit in comparison to other brokers

| Amana Capital | Many Other Brokers | |

| Minimum Deposit | $50 | $500 |

Withdrawals

Additionally, withdrawals and deposits are also handled through your account's online area. In addition, Amana can process transactions quickly , typically within 1-2 business days. If you use its prepaid card, there are no charges waived on withdrawals, however other methods, depending on the locality may charge charges.

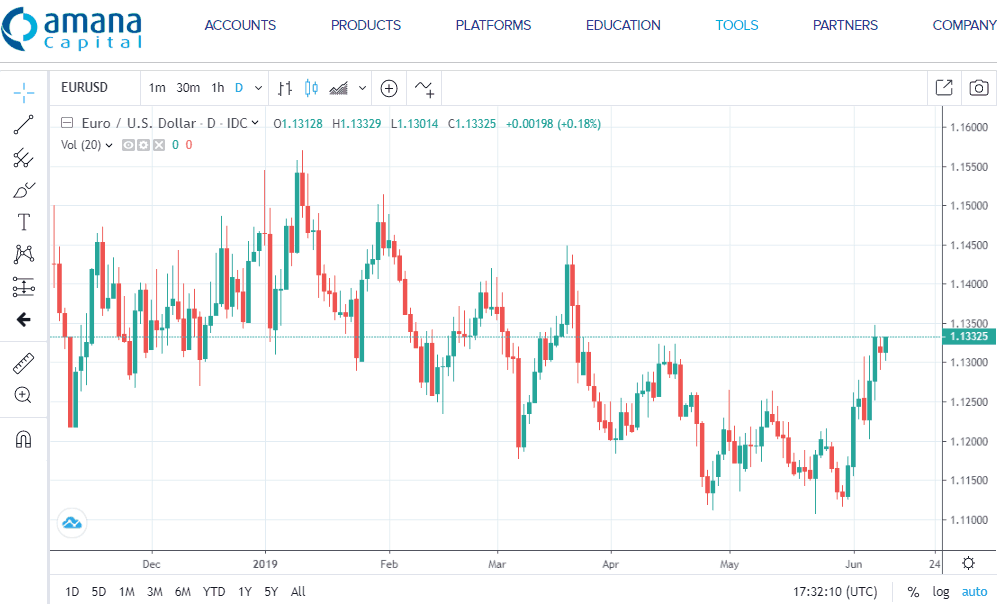

Trading Platforms

The option of Amana Capital platforms offering the leading market MetaTrader software with the option between MT5 as well as MT4.

| Pros | Cons |

|---|---|

| MT4, MT5 and MultiTerminal | No proprietary trading platform |

| Exclusive tools for trading | |

| Social trading and auto trading | |

| Multilingual support | |

| Analysis of technical aspects | |

| Mobile trading apps for trading |

Web Trading

Both platforms let you create orders, verify balances, copy trading or use automatized trading. There are MT5 as well as MT4 platforms are available to trade across a variety of devices, including Internet use, including PCs, mobile devices, and tablets. The Web Version is simple one, yet allowing you to connect to any device via the browser.

Desktop Platform

In contrast, MT5 is the most recent version of the most popular platform MT4, it comes features a powerful multi-feature platform that offers trading tools, as well as a range of pre-installed technical indicators as well as live pricing. It offers robust features and tools for customization.

Also as it is also true that the MT4 platform remains accessible to those who want to stick with it, with a variety of variants and MultiTerminal capabilities.

Mobile trading

Mobile apps are included in the package too and allow you to download a compatible app for iOS as well as Android, iOS for tablet devices, and iOS for tablet.

Additionally, to improve the trading experience, The free VPSallows to make trades automated without the requirement of being in contact with the platform via devices. VPS executes trades quickly via remote access and is accessible for free to live account holders who maintain the minimum equity of 5000$.

Customer Support

In general, with its particular focus in it's focus is on MENA zone and the coverage of different countries, the company is also can provide high-quality trading conditions assisted by specific system of management and the tools needed to its customers.

Contact teams via live chat, the phone and also through social media platforms like Facebook, Twitter, Telegram or WhatsApp or by requesting a an appointment to call them back 24/5.

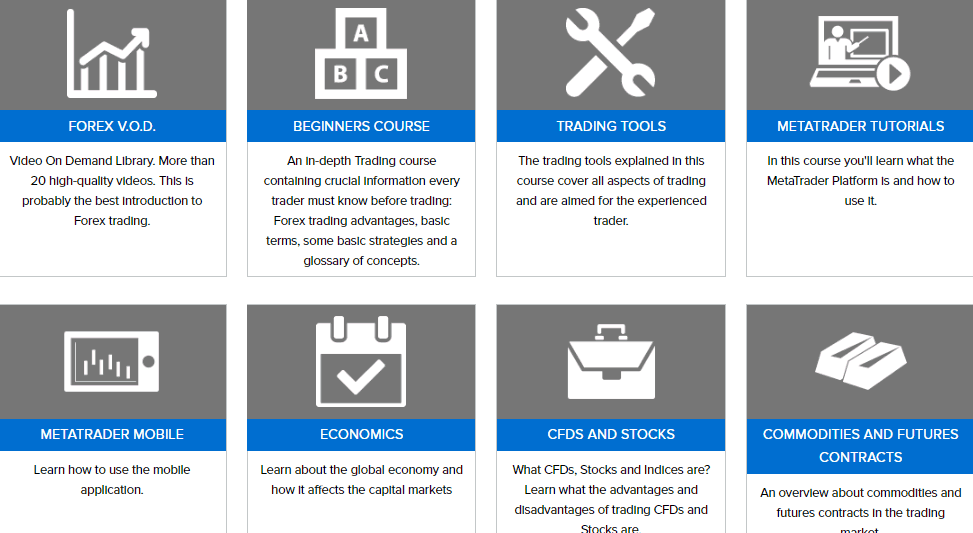

Education

With its international expansion and a focus on development clearly, Amana group established a company TradeCaptain.com, which offers an array of educational tools, insightful analytics and updates to help traders to be successful with trading.

In addition, there is daily market analysis forecasts, SMS alerts and daily market analysis delivered to clients via the portal, as well as the other top research companies like Trading Central, Claws and Horns and Autochartist.

Conclusion

Amana Capital review Amana Capital review presents a global broker that is operated through five international offices and provides complete trading and trading services across a wide range of instruments and tools. Since it is regulated, there is an array of options for platforms, tools for trading and instruments, in addition to the different types of accounts that offer a variety of ways to sign up for trading. Beginners can benefit from the learning resources and a only a small amount of money to get started at just 50$. Meanwhile, professional traders will be able to find strong trading tools that come with reasonable costs.

| Properties | Values |

|---|---|

|

Name

|

Amana Capital |

|

Minimum Diposit

|

$ $50 |

|

Leverage

|

1:30 | 1:500 |

|

Regulation

|

CMA (Kenya),FSC (Mauritius),DFSA (United Arab Emirates),FCA (United Kingdom), |

|

Headquarters

|

United Kingdom |

|

Established

|

2010 |

|

Address

|

32 Ludgate Hill, London, EC4M 7DR, United Kingdom |

|

Platform

|

MT4,MT5, |

|

Payment Method

|

Visa,Mastercard,Credit Card,Wire,Skrill,Neteller,Perfect Money,Webmoney,Maestro,Fasa Pay,Union Pay, |

| Properties | Values |

|---|---|

|

Spreads

|

1.4 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),ECN (electronic communications networks),Instant Execution,,,,, |

|

Account Type

|

Mini account,Scalping,High Leverage,Islamic account,Standard, |

|

Brokers by Country

|

UK Forex Brokers, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers,Day Trading Brokers, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,CFD Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers,Metal Trading Brokers,Indexes Trading Brokers, |

|

Account currency

|

USD,EUR,GBP, |

|

Tools

|

Charting Software, |

|

Website Languages

|

en, |

|

Support languages

|

en, |

|

Bonus

|

Yes |

|

Reviews Rating

|

4.0 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. FCA Regulated. 2. MT4, MT5 Trading Platfrom. |

|

Cors

|

1. Customer Support 24/5. |

|

Display Analysis

|

Yes |

|

Serving country

|

CY,LB,MY,MU,AE,GB, |

|

Not Serving country

|

CA,CU,IR,IL,JP,KP,MY,US, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

MAMM,Zulu trade,Myfxbook Auto trade,Mql5 signals, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44 207 248 6494 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *