Advanced Markets Broker Reviews and Full Information

What exactly is Advanced Markets?

Advanced Markets is incorporated in the Cayman Islands, a foreign company registered in the Cayman Islands. It is well-capitalized and with Macquarie Americas Corp Inc. which is a wholly owned company that is a subsidiary of Macquarie Bank.

The company was founded with the intention of facilitating the creation of a secure and transparent trading environment that provides the most complete Direct Market Access (DMA) liquidity technology, credit and credit options to international exchange market, energy, precious metals and CFD market.

The firm provides wholesale services to clients of institutions around the world, offering trade execution, as well as primary brokerage solutions to hedge funds, banks and commodity trading consultants, corporations and other institutions market participants.

Advance Markets Both Pros And Cons

Advanced Markets the broker offers a solution for corporate and wholesale customers in addition to acting as a technology and liquidator. If you are a retail trader is a great opportunity to profit from Advanced Markets unparalleled reliability and reliability, as well as prime of Prime credit solutions and the ability to access a bank as well as non-bank ECN multi-asset class liquidity with low and competitive spreads . Advanced Market provides a 100% assurance on all client transactions which are immediately passed to the liquidity providers. Furthermore, the broker doesn't accept the risk of taking Market risk.

Cons Cons this proposal, it could be better suited for professional and advanced traders There isn't any adequate education.

10 Points Summary

| Headquarters | Cayman Islands |

| Regulation | ASIC, FCA |

| Instruments | Energy, Foreign Exchange precious metals, foreign exchange, and CFD markets |

| Platforms | MT4, DMAhub, Fortex 5 and 6 |

| Spread EUR/USD | Spread + commission $20.00 for USD million |

| Demo Account | It is a service that is offered |

| Base currencies | EUR USD, EUR |

| Minimum deposit | 2,500 US$ |

| Education | Tools for research |

| Customer Support | 24/5 |

Does Advanced Markets safe or a fraud?

Yes, Advanced Markets is not fraudulent, it is a licensed broker that has minimal risk trading.

Advanced Markets Group has formed the Advanced Markets Group has formed Advanced Markets LTD ("AMLTD") as an Cayman Islands corporation in order to offer the services under the supervision of a governance system that allow it to offer a wider selection of products to its customers.

However, since it is located in one of the offshore zones, broker's trusted Registration is Advanced Markets Limited performed by obtaining an Australian financial service licence (AFSL) No. 444649. It is also a registered foreign company with the Australian Securities & Investments Commission (ASIC).

Although ASIC is a strong regulator, the regulation it provides to those of the Advanced Markets applies in respect to Australian financial services only. Being a licensed firm this license assures that market participants are in compliance with their legal obligations to run fair and transparent markets.

In addition, the funds of the client are held according to the rules of segregated client trust accounts, which are distinct from firm capital. Client funds and firm funds are stored at internationally-rated banks, which include Bank of America, Citi, Macquarie Bank and Deutsche Bank.

Leverage

Leverage levels for advanced markets are are typically set to a minimum that is 1:100 for foreign currencies. But, trading another instrument or dependent on the volume of trades available levels can differ. Additionally, every type of client gets a solution specific to their demands of their clients, which is why Advanced Markets is indeed quite adaptable in this area too.

Types of accounts

The account is defined according to the nature of clients and can be accessed by either an corporate or individual type of account. Because of the licensing and registration of companies, Advanced Market can only accept clients registered with a company registration and license. Advanced Market can only accept clients who are a Wholesale client as defined in the sections 761G(7) as well as 761G(A) from the Australian Corporations Act.

Fees

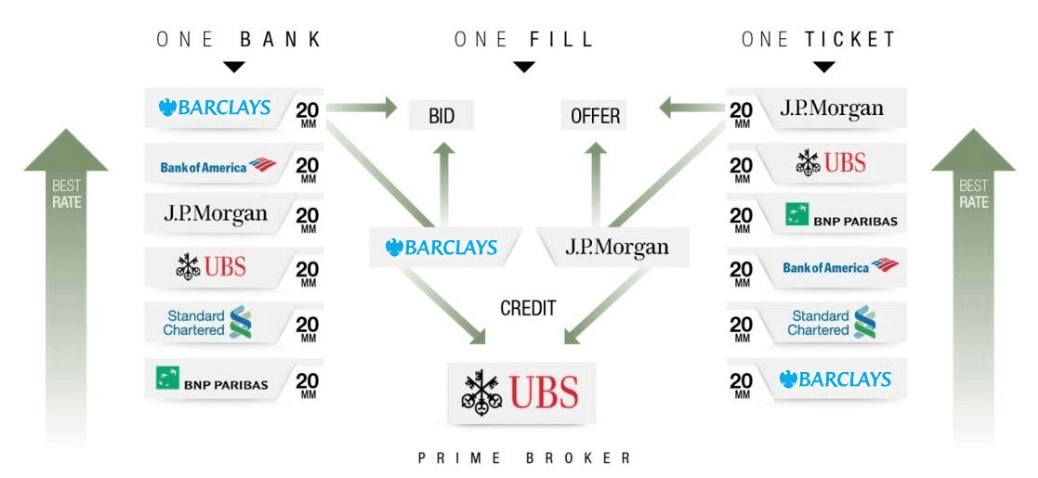

Advanced Marekets costs and prices are based on commissions because the broker offers an anonymous, low-latency connection to multi-asset, multi-bank liquidity, which makes it an attractive alternative to one-bank and multi-bank RFQs and ECN models that are available to traders at institutions. Recent developments, such as the FOX Block Full Order Execution and the order trading method, have been drawing the interest of hedge funds and asset managers, as well as commodities trading experts (CTAs) along with corporate treasuries that could provide an entire solution.

| Fees | Advanced Markets Fees | AAATrade Fee | CommSec Fee |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Fees for withdrawal | No | No | No |

| Commission fee base | Yes | Yes | Yes |

| Fee position | Average | Low | Low |

Spreads

Advanced Markets spread is customized solutions that meet the client's needs and needs. The trading costs will be determined according to an interbank spread in addition to commissions. The standard commission, which is fixed to $20.00 per USD million. However, this standard can be negotiated depending on the volume of transactions and the service offered.

You can also examine Advanced Markets fees to another prominent brokerage AAATrade.

Payment Methods

This is an Advanced Market for the payment options that provide only the possibility to transfer and receive withdrawals via Bank Wire Transfer.

The process of wire money is generally the most convenient method to fund your Advanced Markets trading account, therefore the broker categorized this method as the most important option. To guarantee the security of the data sent over the Internet electronic funds use the multilevel server system, which is equipped with the most recent encryption software, which performs secure transactions.

Minimum deposit

The minimum amount required to set up an account with Advanced Markets of 2,500dollarsat at the first account you open an account, and based on the kind of customer you are.

Advanced Markets Minimum deposit in comparison to other brokers

| Advanced Markets | Many Other Brokers | |

| Minimum Deposit | $2,500 | $500 |

Trading Platforms

Advanced Markets as a technology-driven company is aware of the necessity of having a strong and non-latent technology infrastructure one that meets the needs of all institutions FX market participants including fund managers and banks to retailers, brokers, and aggregaters.

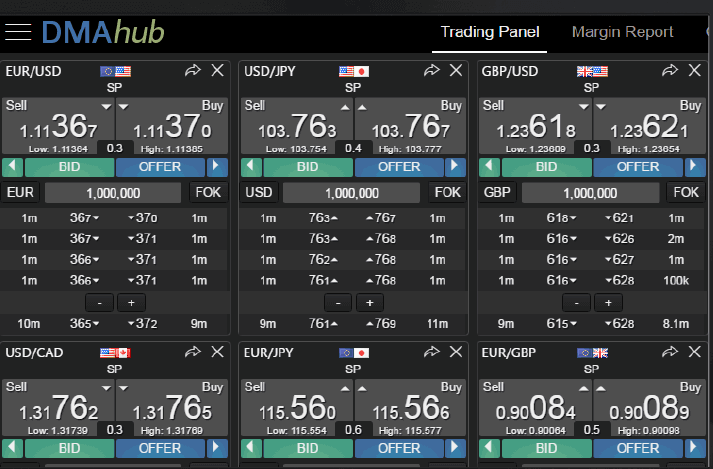

The platform's offerings as well as the technology behind them were developed to allow Direct Market Access (DMA) through GUI Bridge, GUI, or FIX API.

Desktop trading

The variety available on the trading platform includes customized options developed by the proprietary team and the market leaders MetaTrader4 and MetaTrader5. MetaTrader4 as well as MetaTrader 5. Along with the strong trading software, you'll have the ability to set up liquidity and select from a range of pricing options, which includes banks as well as non-banks, and ECNs with layers that are defined top of book, VWAP, and more..

Advanced Markets also partnered with First Derivatives to create the fully customizable DMAhubtrading marketplace that is easily accessible via both FIX API as well as GUI. DMAhub lets traders to customize their personal trading environment, with a degree of granularity that's different from the current market.

DMA trading

Another option is the powerful Fortex 5 and its newer version Fortex 6 offers the ability to immediately access DMA liquidity through multiple channels and all of it with a fully functional, real-time reporting suite. In the event that the business decides to utilize Metatrader4 software, Metatrader4 software, direct connectivity via Fortex's bridge MT4 technology is a great option.

Each of these options comes with credentials that allow access to Advanced Markets' back-end reporting that provides full transparency of every transaction, P&L and end-of-day roll pricing, amongst others.

Conclusion

All in all, Advanced Markets is a model of broker that is able to take the multi-bank competitive aspects of RFQ platforms, and combines their low latency the transparency, and security and security of ECNs offering services for traders looking for reliable and consistent interbank liquidity. In addition to its sophisticated choices for traders or institutions, a range that is characterized by its efficiency and a wide selection of cutting-edge platforms. Advanced Markets definitely a company of advanced.

| Properties | Values |

|---|---|

|

Name

|

Advanced Markets |

|

Minimum Diposit

|

$ 2500 |

|

Leverage

|

1:100 |

|

Regulation

|

ASIC (Australia),FCA (United Kingdom),,, |

|

Headquarters

|

Cayman Islands |

|

Established

|

2006 |

|

Address

|

94 Solaris Avenue, Camana Bay, P.O. Box 1348, GrandCayman, KY1-1108, Cayman Islands |

|

Platform

|

MT4,MT5,MT4 WebTerminal,MT5 WebTerminal,,, |

|

Payment Method

|

Wire,,, |

| Properties | Values |

|---|---|

|

Spreads

|

0.5 |

|

Min Position size

|

0.01 |

|

Broker Type

|

ECN (electronic communications networks),,, |

|

Account Type

|

Mini account,Scalping,High Leverage,Standard,,, |

|

Brokers by Country

|

Australian Forex Brokers,UK Forex Brokers,,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Spread Betting Brokers,Automated Trading Brokers,Mobile Trading Brokers,,, |

|

Instruments

|

Forex Trading Brokers,Futures Trading Brokers,Gold Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers,Metal Trading Brokers,Indexes Trading Brokers,,, |

|

Account currency

|

USD,EUR,GBP,AUD,CAD,JPY,NZD,XAG,XAU,BTC,,USD,,USD, |

|

Tools

|

Charting Software,,,, |

|

Website Languages

|

en,,, |

|

Support languages

|

en,,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Advanced Market delivers guarantee on all client positions that are instantly passed straight through the liquidity providers while the broker does not take any Market risk |

|

Cors

|

1. The proposal might be more suitable for advanced and professional traers, there is no proper education. |

|

Display Analysis

|

Yes |

|

Serving country

|

AU,GB,US,,, |

|

Not Serving country

|

CN,US,,, |

|

Contests

|

No |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

Yes |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

PAMM,MAMM,Zulu trade,Myfxbook Auto trade,Mql5 signals,,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+1 704-544-9446 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *