ADS Securities Broker Reviews and Full Information

What is ADS Securities?

ADS Securities or ADSS is a group of offices situated in major financial capitalslike London, Hong Kong, Singaporeand are owned by ADS Holding LLC. ADS Holding LLC based in Abu Dhabi established in 2011.

In actuality the Holding is among only a handful of investment companies that have were granted an authorization through Abu Dhabi Central Bank as well as affiliated offices approved by the relevant authority, which includes FCA in the UK as well as SFC for Hong Kong.

At present, ADS Securities is the largest foreign exchange trader across the UAE and serves central banks as well as brokers, asset managers as well as hedge funds. ADSS are focused on creating solid, long-lasting relationships with corporate or institutional clients, and to offer an array of top-quality services and solutions

ADS Securities Pros and Cons

ADS is a well-known Broker with a large expansion MENA region. Trading conditions are competitive thanks to an easy account opening process that is digital as well as various tools, platforms and a educational section. Commissions and spreads are average and there is a variety of instruments available.

On the other hand, the fees for trading in Stock CFDs are more costly as well as there isn't 24/7 assistance.

10 Points Summary

| Headquarters | Abu Dhabi |

| Regulation | UAE Central Bank, FCA, SFC |

| Instruments | 60plus currency pairs, and more than 1000 CFDs, indexes, commodities, treasuries, and single stocks. |

| Platforms | OREX, MT4 |

| EUR/USD Spread | 1 pip |

| Demo Account | Provided |

| Minimum deposit | 100$ |

| Base currencies | EUR, USD, GBP, |

| Education | Daily market briefings reports on technical analysis, trading signals and sentiment data |

| Customer Support | 24/5 |

Awards

With its wide-ranging influence is the fact that it has received many international awards magazines in addition to ADSS is proud to be a patron of numerous organizations within the UAE and across the globe.

Are ADS Securities safe or a fraud?

Absolutely not, ADS Securities is not fraud, but it is a licensed broker that offers very low risks Forex as well as CFDs.

ADS encompasses both institutional and private investment activity through affiliated centers. each jurisdiction has ratified the ADSS firm's regulations accordingly..

ADS Securities L.L.C. is a limited-liability business founded under U.A.E. law. The company exists licensed by the Department of Economic Development of Abu Dhabi and is authorized from the Central Bank of the United Arab Emirates to operate as a bank

| ADSS entity | Regulation and License |

| ADS Securities L.L.C. | The resolution was approved through Central Bank of the United Arab Emirates resolution Numbers 164/8/1994 as well as Resolution Number 126/5/1995 |

| ADS Securities London Limited | Registered through FCA (UK) Registration number. 577453 |

| ADS Securities Hong Kong Limited | Registered by SFC (Hong Hong Kong) registration number. AXC847 |

Additional licenses issued by the respected UK FCA and Hong Kong SFC are and will be implementing the required guidelines on how brokers work, and traders from various regions and jurisdictions are able to enjoy trading leveraged FX as well as futures, securities and contracts.

Overall, the sharp regulation implies that ADSS provides its trading services in a transparent manner, adhering to international rules and regulations to manage traders' funds. The steps are commitment to compliance procedures segregation of funds of clients and the financial services compensation shames, and generally good practices.

Trading Instruments

As for broker's business, they are split to two primary streams: private investment and corporate or institutional investments.

ADS Securities ADS Securities provides more than 10,000 instruments such as commodity trading, foreign exchange and multi-asset investment classes including forex that includes 60+ currency pairs, more than 1000 CFDs, indexes, Treasury securities, commodities and single stocks as well as ADS MT4 Plus is the only Spread Betting platform available to UK customers and residents only.

Leverage

ADSS gives leverage 400:1 or more on a variety of FX pairs and indexes that are still available in the event that you are a client with a Hong Kong or UAE entity. It is an established fact that different jurisdictions and recognized authorities used various permissible amounts of leverage.

- So, you can be able to enjoy an extremely high leverage amount at ADSS however, if you reside in EEA you'll be treated as per the FCA regulations and the maximum leverage allowed is 1:20 in the case of major currencies and 1:20 for the minor ones as well as 1:10 when it comes to commodities.

Furthermore, because ADSS provides flexible leverage, the amount of leverage available is dependent on the kind of account you're trading.

Types of accounts

ADS accounts that offer three types of accounts -Lite Account (the most suitable choice for first-time traders, with special incentives, minimal deposit only 100$, fixed spread around 2.4 pip and protection against negative balances however, only available at MT4) Classic Account (easy to manage and trade account, has a minimum deposits of 5,000$, competitive spreads starting at 1.6 per cent and with no fee) and -Elite Account (designed for clients who have VIP deposits of more than 200 000$ or greater than $500 million in trades per month, with a range of benefits and prices that are bespoke).

In addition to the other standard options, ADSS supports a specific account for fund managers and asset managers to manage their trades and clients - either MAM and the PAMM. But, once again, be sure to verify which account is appropriate to your state and your residence.

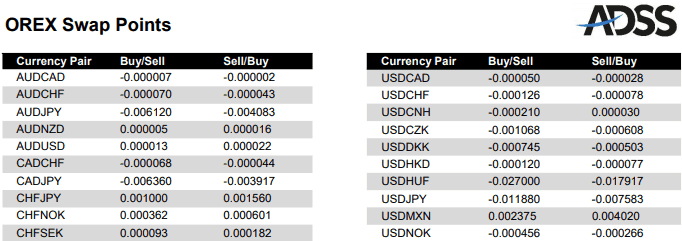

Swap-free

Because ADSS is the ADSS is the most reputable MENA broker it is no surprise that they offer a swap free account as well. This account does not have swap or rollover interest on overnight transactions which offers all the benefits that come with Classic or Elite accounts, but is specifically tailored for traders who adhere to Sharia rules.

Fees

ADS Securities fees are mainly comprised of a spread that is defined by the instruments. It could differ depending on the organization of ADS you trade with. The table below shows the pricing and additional charges like inactivity fees or funding fees to be taken into consideration.

| Fees | ADS Securities Fees | Valutrades Fees | AETOS Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee rating | Average | Low | Average |

Spreads

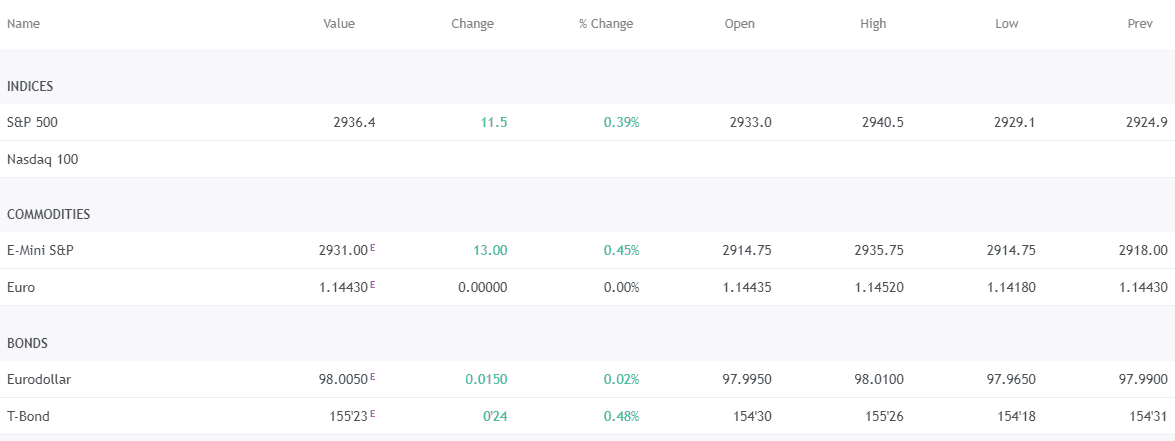

For a better understanding of ADS charges for securities, check below the typical spreads for most the most popular instruments offered by ADSS which we classify with respect to the average level, additionally you can look at fees compared to another well-known broker IG Markets.

| Asset | ADS Securities Spread | Valutrades Spread | AETOS Spread |

|---|---|---|---|

| EURUSD Spread | 1 Pips | 0.3 pip | 1.24 Pips |

| Crude Oil WTI Spread | 4 pip | 1 pip | 5 |

| Gold Spread | 5 pip | 1 Pips | 26.82 |

Deposits and Withdrawals

There are many ways to fund your ADS trading account. The broker accepts debit and credit card payment as well as bank transfer with 13 different fund-raising currencies, including AED, GBP EUR USD, JPY and many more. Additionally, you are able to make use of popular e-wallets, however be sure to check the restrictions based on your location, since different rules may apply.

Minimum deposit

The minimum amount to deposit is 100$ This allows even novice traders to create an account and get in the trading world without difficulty.

ADS Minimum deposit is different from other brokers

| ADS Securities | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdrawal

In relation to the fee for withdrawals and deposits in accordance with the policy of the company, the client is accountable for the conversion fee that are charged by the bank, or any other fees imposed by the bank. The the broker is not liable for additional charges for transfers.

Trading Platforms

ADS Securities has developed truly multi-asset trading tools that offer an opportunity to trade profitably using the tools that optimize trading strategies. This is accompanied with complete support and training.

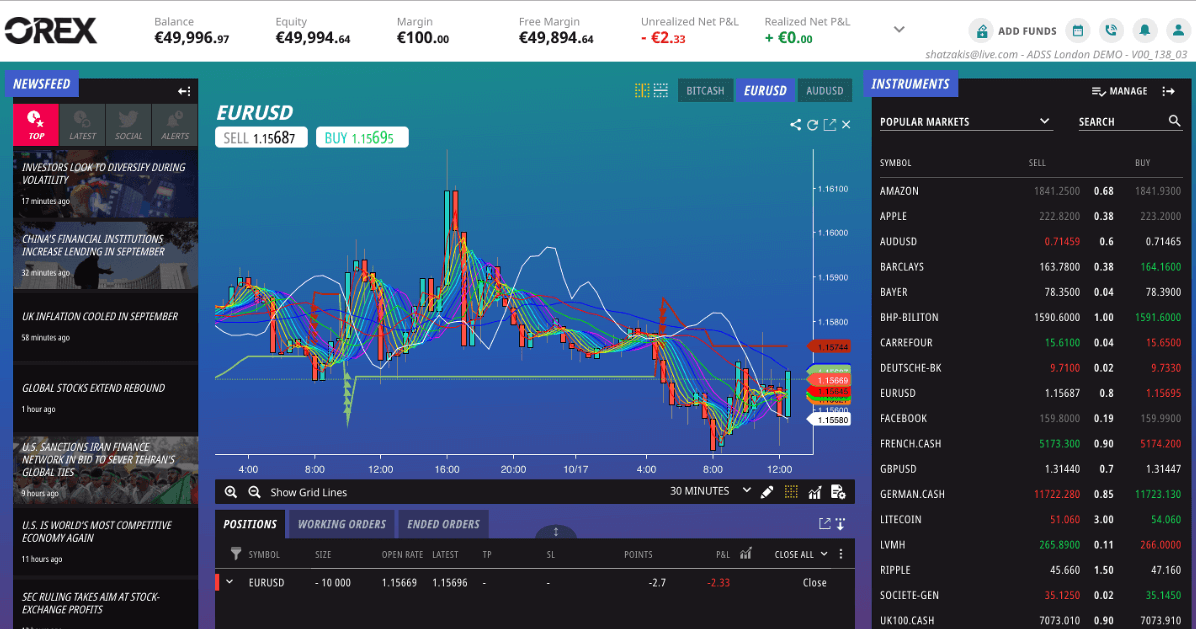

With an advanced software platform that you can choose from two major trading platformsthat most suitable for your trader's needs - OREX which is a proprietary multi-asset platform that is low-latency or the MT4 platformthat offers the familiarity of the most well-known platform.

OREX is an incredibly new platform created by ADS Securities offering exceptionally latency and order processing. Platform is available on desktop and mobile devices. It provides an intuitive navigation system, as well as positioning and management of risk. Apart from being the OREX the market depth function the real-time volume of trade displayed through five levels of market makes it a highly advanced option for professionals.

But, ADSS MT4 has been developed in conjunction with MetaQuotes which has enhanced trading services through pricing, liquidity and assistance from the ADS, as well as community-sourced indicator and EAs. In addition it is possible to access this MT4 platform is accessable via iOS and Android gadgets.

Research

The most discerning traders can benefit by combining the latest technology and award-winning customer support between East and West and a variety of account benefits as well as constant promotions.

Furthermore, to stay ahead brokers provide an every day market review which helps make better trading strategies using Forex and CFDs that include regular market updates and technical analysis reports, trading signals, and sentiment data that are available in a variety different styles of trading.

Conclusion

In the appealing ADS Securities features we finalize an incredible array of investments and trade deals to both individuals and institutional customers. Their technology solutions and their optimization together with rules and regulations, and built confidence, the overall perception is extremely favorable. Proposal scope is executed in a way to meet the requirements of every client regardless of their the location or "business mindset". But, it is important know that the brokerage functions in accordance with the client's residency registration. There is a few differences in the available regulations and offers, which should be checked prior to making an application for an account.

| Properties | Values |

|---|---|

|

Name

|

ADS Securities |

|

Minimum Diposit

|

$ 100 |

|

Leverage

|

1:400 |

|

Regulation

|

SFC (Hong Kong),FCA (United Kingdom), |

|

Headquarters

|

United Arab Emirates |

|

Established

|

2011 |

|

Address

|

8th Floor, CI Tower, Corniche Road, P.O. Box 93894, Abu Dhabi, United Arab Emirates |

|

Platform

|

MT4,MT4 WebTerminal, |

|

Payment Method

|

Visa,Mastercard,Wire,Skrill,Neteller,Maestro,CashU, |

| Properties | Values |

|---|---|

|

Spreads

|

1 pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

NDD (Non Dealing Desk),Instant Execution,,,, |

|

Account Type

|

Mini account,High Leverage,Standard, |

|

Brokers by Country

|

UK Forex Brokers, |

|

Techniques

|

Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers,Day Trading Brokers, |

|

Instruments

|

Forex Trading Brokers,Futures Trading Brokers,Gold Trading Brokers,Crypto Trading Brokers,Oil Trading Brokers,Commodity Forex Brokers, |

|

Account currency

|

USD,EUR,GBP, |

|

Tools

|

Economic Calendar,Charting Software, |

|

Website Languages

|

en, |

|

Support languages

|

en, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

No |

|

Trading Signals

|

No |

|

Free Education

|

Yes |

|

Daily News

|

No |

|

Demo account

|

No |

|

Swapsr

|

Yes |

|

Pors

|

1. MT4 Trading platform Available. |

|

Cors

|

1. Customer Support 24/5 |

|

Display Analysis

|

Yes |

|

Serving country

|

CN,HK,AE,GB, |

|

Not Serving country

|

US, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

Yes |

|

Social trading

|

No |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

Yes |

|

Hedging

|

Yes |

|

PAMM

|

Zulu trade,Mql5 signals, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+971 2 652 9777 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *