Abshire Smith Broker Reviews and Full Information

What exactly is Abshire Smith?

Abshire Smith is a London based brokerage firm that offers a vast of derivative products across a number of platforms and connections, including foreign exchange (FX), contracts-for-difference (CFD), precious metals, soft commodities as well as Futures, Equities and Securities.

One of the most impressive aspects of Abshire Smith is that the Broker functions in the role of intermediary for customers via three trading platforms including FIX/API connections, bridges between platforms that connect orders to liquidity providers, aggregators , and major exchanges.

Abshire Smith Pros and Cons

Abshire Smith is a Regulated broker with a solid track history, a wide instrument selection and the option of Standard and commission-based accounts.

Cons Cons There is no extensive education resources and 24/7 customer support.

10 Points Summary

| Headquarters | UK |

| Regulation and License | FCA |

| Instruments | CFDs, FX precious metals, commodity, Futures, Equities and Securities. |

| Platforms | VertexFX10, MT4, Straticator |

| Costs | 0.8 Pips |

| Demo Account | It is a service that is offered |

| Base currencies | USD, EUR, GBP |

| Minimum deposit | 250$ |

| Education | A regular market analysis and up-dates |

| Customer Support | 24/5 |

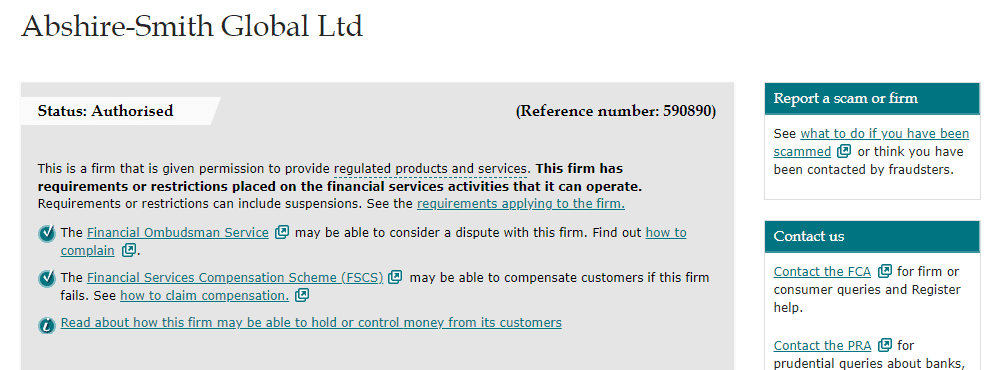

Is Abshire Smith safe or is it a fraud?

It's not a scam. Being a UK based company, Abshire Smith Global Ltd is regulated and authorized under the Financial Conduct Authority. Therefore, in conformity with regulations, Abshire Smith Global Ltd is required to inform clients regarding the steps taken to ensure the highest possible results , regardless of the execution of orders, compliance with regulations that apply or money processing. This results in Abshire a broker with low risk.

This signifies Abshire Smith Abshire Smith is in compliance with the strictest standards and rules as required by international standards, and has a strict adherence to the principle of transparency. In addition, the regulator supervises operations on a continuous basis to ensure compliance with the regulations enacted by law and the best practices.

Additionally the client's funds are kept in segregated accounts for clients and are protected by FSCS (Financial Services Compensation Scheme).

Leverage

Leverage is an extremely well-known instrument, that obviously increases the capital you started trading with. It is an extremely useful instrument to boost your profits, but only when you utilize it correctly.

Abshire Smith, as a regulated broker within UK jurisdictions is able to offer various trading conditions based on the regulations are set. Thus, operated under the European FCA regulation you are able to use a limited leverage up to 11:30 maximum in Forex instrument.

Types of accounts

A trading account through Abshire Smith enables to access the world's financial markets, and the variety of accounts available each account's specifications for the three trading platforms offered by Abshire Smith.

Furthermore, new traders or those looking to test the corporate trading environment can utilize the system via Demo accounts.

Additionally, Abshire Smith offers Shariah conforming trading account and also features known as an Islamic Account with no swaps.

Fees

Abshire Smith delivers choice between the fixed spread or NDD connectivity to liquidity providers and a the raw spread offering. The commission is paid per lot of traded. The fee table is also available below.

| Fees | Abshire Smith Fees | FXTM Fees | City Index Fees |

|---|---|---|---|

| Deposit Fees | No | No | No |

| Fees for withdrawal | No | No | No |

| Fee Ranking | Low | Average | Low |

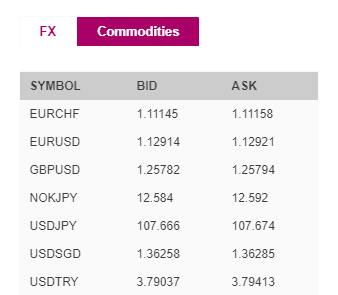

Spread

In general, the Abshire Smith EURUSD spreads is approximately 0.8 percent. Abshire Smith can offer NDD execution to Forex FX, CFDs and Equities. Connectivity to futures and equity on exchange trading is available to clients who are VIP or institutional either via either an API and/or FIX connection.

| Asset | Abshire Smith Spread | FXTM Spread | City Index Spread |

|---|---|---|---|

| EUR USD Spread | 0.8 pip | 1.5 pips | 0.5 pip |

| Crude Oil WTI Spread | 3 | 9 | 4 |

| Gold Spread | 30 | 9 | 0.3 |

Abshire Smith payment methods

When you've established a live account, funding your trading account is available through any of the three options: deposit money at your nearby bank, make online debit or credit card transfers or transfer funds to an account via an electronic wallet or payment processor. The selection of payment options for the clearing of deposits and withdrawals from your trading account comprises

- Bank Deposits

- Credit/Debit Cards , while payments are is processed through Skrill,

- and the e-wallets CashU as well as Neteller.

When you've established a lice account financing your trading accounts is made through one of three choices: deposit money at your nearby bank, make an online debit or credit card transfer or transfer funds to an account using an electronic payments gateway. The payment options for the clearing of deposits and withdrawals from your trading account include the Bank Deposits and Credit/Debit Cards , payment processed through Skrill and Neteller, as well as electronic wallets CashU as well as Neteller.

Minimum deposit

The Abshire Smith minimum deposit is 250dollars, which permits traders of all sizes from the beginning to experienced traders to sign up.

Abshire Smith minimum deposit in comparison to other brokers

| Abshire Smith | The majority of other brokers | |

| Minimum Deposit | $250 | $500 |

Withdrawals

Abshire Smith withdrawal options include Bank Wire, range of debit and e-wallets. To cover transaction costs Abshire Smith does not charge any additional fees for withdrawals or deposits which are also contingent on the payment method you select. But, make sure to check with your provider of payment to see if charges are waived.

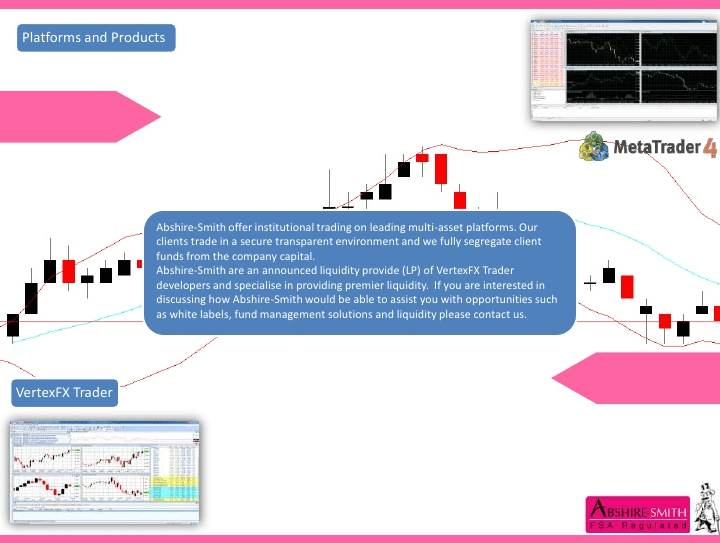

Trading Platforms

Abshire Smith provides 3 most popular custom trading platform with secure servers that are dedicated to you and the choice of mobile, web or download-able platforms to use for trading. The method of execution can differ in accordance with the account you choose because they are connected directly to the trading platform, and they depend on the size of the trading operation.

So, read below for information about each and then choose the most suitable option for you.

-- VertexFX 10allows trading CFDs and FX via the trading platform, offering rapid and effective trade execution, with fixed spreads. The the platform itself is a desktop- or internet-based download software. It is indeed an extremely comprehensive trading suite. Abshire Smith works closely with the developers to ensure that it is well-optimized, and for institutional customers, The broker also offers the VertexFX 10-Bridge.

Desktop

MetaTrader4 (MT4) is offered by Abshire Smith. Smith also provides access to CFDs and FX (Indices, Commodities, Metals and Energies) and is accessible as a desktop application and it is a mobile app (iPhone, iPad and Android. It is a market leader in the field. program, MT4 sophisticated charting features and tools are suitable for a variety of traders' needs and trading strategies.

The final, but certainly not the least, is an stratticator-based platform with the ability to trade on exchange-traded equities in conjunction with an DMA ECN, STP, or and the NDD FX Model. The multi-asset model has been created from a consumer's perspective it comes with the important tools and essential functions and is accessible via a web-based application and also as a mobile app.

Customer Support

If you are satisfied with the assistance you can rest assured that your requirements will be met completely by Abshire Smith always available, and the customer support team gives confidence to any questions you may have. Additionally the frequent market analysis and news regarding the current market trends enable you to make more informed decisions and execute a superior quality trading using the most current information available.

Conclusion

Overall the Abshire Smith review offers an institution that has a strict regulatory framework and a wide range of trading opportunities , and sophisticated choices between trading platforms, or even accounts associated with the platforms. The broker offers an possibility for clients with different types of portfolios and types to participate and also offers a variety of choices to select from and could benefit from cost-effective pricing. Employing an agency-only business model, Abshire Smith is Abshire Smith is unable to keep proprietary positions or expose itself to market, allowing you to trade in a relaxed state in your mind. You can also trade in a transparent manner.

| Properties | Values |

|---|---|

|

Name

|

Abshire Smith |

|

Minimum Diposit

|

$ 250 |

|

Leverage

|

30:1 |

|

Regulation

|

No Regulation,, |

|

Headquarters

|

United Kingdom |

|

Established

|

2011 |

|

Address

|

26 York Street London, W1U 6PZ, United Kingdom |

|

Platform

|

MT4,MT4 WebTerminal,, |

|

Payment Method

|

Visa,Mastercard,Wire,Skrill,Neteller,CashU,, |

| Properties | Values |

|---|---|

|

Spreads

|

0.8 Pips |

|

Min Position size

|

0.01 |

|

Broker Type

|

STP (Straight Through Processing),Instant Execution,,,, |

|

Account Type

|

Mini account,High Leverage,Islamic account,Standard,, |

|

Brokers by Country

|

UK Forex Brokers,, |

|

Techniques

|

Scalping Forex Brokers,Hedging Forex Brokers,Automated Trading Brokers,Mobile Trading Brokers,Day Trading Brokers,, |

|

Instruments

|

Forex Trading Brokers,Gold Trading Brokers,Stock Trading Broke,Oil Trading Brokers,Commodity Forex Brokers,Indexes Trading Brokers,, |

|

Account currency

|

USD,EUR,GBP,,USD, |

|

Tools

|

Charting Software,, |

|

Website Languages

|

en,, |

|

Support languages

|

en,, |

|

Bonus

|

Yes |

|

Reviews Rating

|

3.5 |

|

Withdrawal Fee

|

Yes |

|

Trading Signals

|

Yes |

|

Free Education

|

Yes |

|

Daily News

|

Yes |

|

Demo account

|

Yes |

|

Swapsr

|

Yes |

|

Pors

|

1. Abshire Smith is a Regulated broker with a solid track history, 2. a wide instrument selection and the option of Standard and commission-based accounts. |

|

Cors

|

1. There is no extensive education resources and 24/7 customer support. |

|

Display Analysis

|

Yes |

|

Serving country

|

GB,, |

|

Not Serving country

|

IR,US,, |

|

Contests

|

Yes |

|

Market analysis

|

Yes |

|

Copy Trading Brokers

|

No |

|

Bitcoin Forex Brokers

|

No |

|

Social trading

|

No |

|

Web trading

|

Yes |

|

Forex pairs

|

Yes |

|

CFDs

|

Yes |

|

Crypto

|

No |

|

Hedging

|

Yes |

|

PAMM

|

Myfxbook Auto trade,Mql5 signals,, |

|

Mobile Trading

|

Yes |

|

Scalping

|

Yes |

|

Automated Trading

|

Yes |

|

Partnership Programs

|

Yes |

|

Free Phone

|

+44 (0) 203 700 0085 |

|

Customer Support

|

24/5 |

Exness Broker reviews & comments (0)

Add a review

Your email address will not be published. Required fields are marked *