Euro Fundamental Forecast: EUR/USD Clinging on to 1.1000, Inflation Data Nears

EUR/USD PRICE, CHART, AND ANALYSIS

- EUR/USD - a confirmed break of 1.1000 will set up a run at 1.0800

- Inflation data from the single block may heap pressure on the ECB.

Increased hawkish Fed language, as well as a corresponding rise in US Treasury bond rates, have continued to put downward pressure on the EUR/USD, which is now clinging to the 1.1000 level. Any recent loss below 1.1000 triggers the reemergence of buyers, who attempt to maintain the pair's stability by buying any little gains in the price. Whether or whether there are larger factors at work to keep the EUR/USD afloat, there will come a point shortly when swings down will quicken, as a result of the widening yield difference between USTS and Bunds, putting the recent two-year low just around 1.0800 at danger of being breached. The Federal Reserve is widely expected to raise interest rates by another 150 basis points this year and begin to reduce its USD9 trillion+ balance sheet, while the European Central Bank may raise interest rates by a fraction of a percentage point at the end of 2022 if their growth outlook permits it. As of this writing, the yield gap between the 10-year UST and the 10-year Bund is +190 basis points in favor of the US dollar.

The most recent Euro Zone inflation figures will be announced next week, and it is predicted that price pressures will continue to grow throughout the whole single currency area. ECB board members will have to use their collective bargaining power to force the single currency higher, since the central bank is now unwilling to tighten monetary policy for fear of damaging an already sluggish economic recovery. If inflation continues to rise at its current rate, this is unlikely to have any influence in the medium- to long term. According to forecasts, German headline inflation will increase from February's level of 5.1% to 6.1 percent next week, a level that has not been seen since the early 1990s.

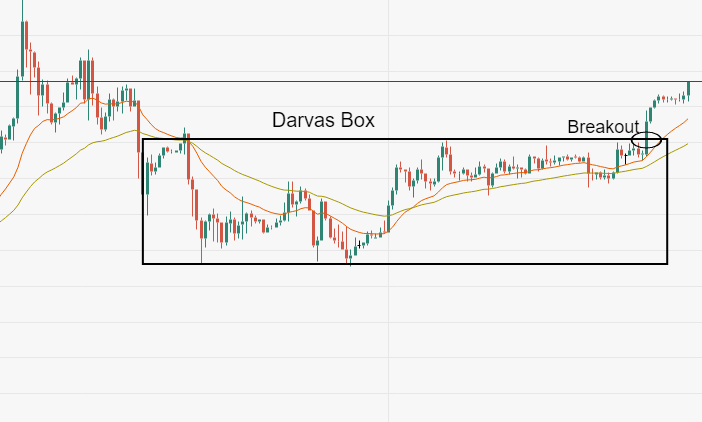

EUR/USD The daily price chart for March 28, 2022 is shown below.

According to retail trader statistics, 62.12 percent of traders are net long, with the ratio of traders who are long to those who are short standing at 1.64 to 1.

There are 1.95 percent more traders net-long today than there were yesterday and 18.00 percent more traders net-long from the previous week, while the number of traders net-short is 1.89 percent lower today than it was last week and 0.71 percent lower than it was the day before.

Since we normally adopt a contrarian stance to crowd mood, the fact that traders are net-long on the EUR/USD implies that the currency pair may continue to decline.

In contrast to yesterday and last week, traders are more net-long today, and the combination of current mood and previous movements suggests a greater EUR/USD-bearish contrarian trading bias.